|

1. How is the Park Bond different from SPLOST?

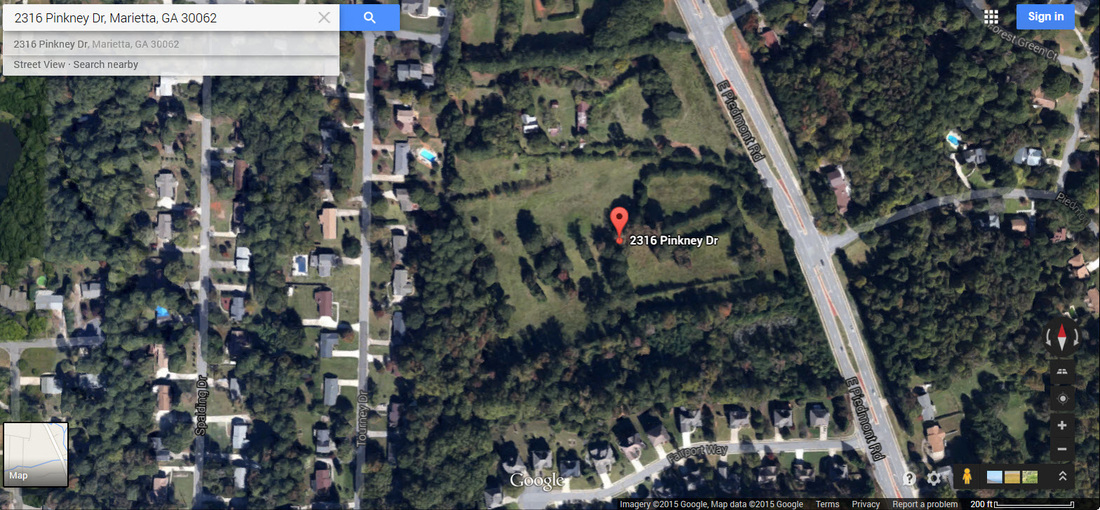

A $40 million Park Bond is a Bond that the County takes out to pay for Parkland (paid for with property taxes), while the SPLOST is a 1¢ (sales tax) that the County adds to certain items to pay for many projects around the County that they choose. Here is the list of the Parklands purchased with the 2006 Park Bond. Here is the list of potential Parkland for the 2008 Park Bond. (Note: many of the properties listed in 2008 have already been purchased by developers, some are under threat of development, but some are still available.) Here is a current list of the projects purchased with the 2011 SPLOST tax. Here is a current list of the planned projects for the 2016 SPLOST. Many budget, SPLOST, and Braves financing decisions will be made at future Board of Commissioners meetings. Please contact the Commissioners soon about using the Park Bond 2008 for parks, before re-purposing it for another project, such as the Braves stadium. 2. Did the 2008 Park Bond cost taxpayers? Why wasn’t the 2008 Park Bond used? No, the 2008 Park Bond was approved but not used or spent. When the economy went south in 2008 and 2009, the County felt that it could not pay the Bond back easily, so it did not purchase any properties and it did not spend any Park Bond money on parkland. However, it’s time to use the Park Bond 2008, especially if this Bond is being re-purposed or re-appropriated to pay for the Braves Stadium, even before being spent of parkland as intended. This is posted on the Cobb County Braves FAQ page: “Will my property taxes be used to pay for this? Currently .33 mills of your property taxes pay for the parks bonds that were issued in 1996, 2007 and 2008.The last of those bonds will be paid off in 2017 and 2018. The millage will then be shifted to the General Fund when these bonds expire to raise an equivalent amount of revenues of $8.67 million. Those monies will then be used to pay for bonds to finance stadium construction. The average amount of .33 mills per household is $26 per year and this shift of funding will not impact other government services such as police, libraries, parks and other services.” Note: Actually the .33 mills is actually only from the 1996 and 2006 (applied in 2007) Park Bonds, as the 2008 Park Bond was never issued. The $40 million Park Bond 2006 was issued in two installments: in 2006, $25 million of the $40 million was issued, and in 2008, $15 million of the $40 million was issued. In other words, part of the Park Bond 2006 money was spent in 2006 and the rest of it was spent in 2008. The Cobb County Braves FAQ is misleading because the real Park Bond 2008 has not been issued yet, but rather Park Bond 2006 was spent in 2 phases. Here is an article about how the Commissioners did not use the 2008 Park Bond money due to the economy. Now that the economy has improved, we need to preserve land, as developers are buying up large tracks of land at a faster rate, and once the land is developed, it will be gone forever. 3. Should the Park Bond money be spent on anything other than Parkland? A voter-approved Park Bond should only be used for Parkland. A Park Bond should not be re-purposed to pay for another project. This is posted on the Cobb County Braves FAQ page: “Will my property taxes be used to pay for this? Currently .33 mills of your property taxes pay for the parks bonds that were issued in 1996, 2007 and 2008.” The Park Bond of 2008 has not been used to purchase parkland yet, but now it appears that it may be extended or re-purposed before being used to pay for the Braves stadium. 4. How does a $40 million Park Bond impact property taxes? Park Bonds affect homeowners property taxes, and the 2006 Park Bond for $40 million, as an example, added only $9/year for a $200,000 home. The 2006 Park Bond will be paid off in 2017. The Park Bond 2008 once implemented would add approximately the same amount, $9/year for a $200,000 home. 5. So only homeowners pay for the Park Bond in affect? Yes, a Park Bond is a property tax (millage), not a sales tax. Park Bond 2008 costs property tax payers about $9 a year. 6. How are Parklands selected once a Park Bond is approved? Generally, once a Park Bond is approved, a Selection Committee made up of citizens who know about potential park property is created to select the land to be purchased. The Committee is tasked with deciding which areas will be purchased with the Park Bond funds. The Park Bond 2008 Committee had already selected a list of properties for purchase. The Board of Commissioners decided to postpone using the Park Bond 2008 due to the tough economy. 7. Is a Park Bond a good use of money? A Park Bond is one of the best uses of Government money because it protects land from overdevelopment, keeps home prices high with a better quality of life, ensures a connected community with safe places to play, and maintains a preserved history and a beautiful environment. 8. Will the Park Bond be shared by all areas in Cobb? Yes, traditionally a Park Bond Committee is made up of citizens tasked with selecting properties from the 4 districts and 6 cities of Cobb. 9. Will the Park Bond be able to acquire the Tritt Property in East Cobb? The Park Bond could be used as part of an overall strategy to pay for and acquire the Tritt property, but only if the zoning changes are not approved. It still remains to be seen if that land will remain undeveloped. The 54-acre Tritt property is the only property listed on both the 2008 Park Bond and the 2006 Park Bond list of ideal properties but not purchased. |

|