Under threat of development: 23-acre Furr Property selected in 2009 for purchase

Under threat of development: 23-acre Furr Property selected in 2009 for purchase MDJ Editorial Park Bonds mixed up in Braves deal and why funding is critical now

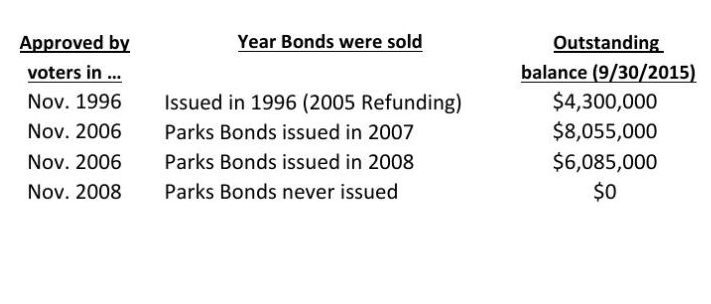

Here’s a short history on how Park Bond 2008 became mixed up in Braves stadium funding:

• In 2008, 67 percent of Cobb citizens voted for a $40 million Park Bond referendum to save land as parks.

• In 2009, the Board of Commissioners chose not to fund the Park Bond due to the economy, though the County notified 29 landowners their properties were ideal for parkland purchase with the 2008 Park Bond.

• In 2013, Cobb County announced the property tax rate originally intended for Park Bond repayment in the Debt Service Fund would be “shifted” into the $400 million Braves stadium financing. The problem with the transfer is it doesn’t include funding the 2008 Park Bond Referendum voters approved.

• Since 2014, the Cobb Parks Coalition and other like-minded groups have pushed for Park Bond 2008 to be fully funded before the tax shift.

To avoid the controversy of Braves stadium funding superseding Park Bond funding, the Board of Commissioners has a simple solution: Fully fund the $40 million Park Bond approved by referendum before moving the Debt Service Fund taxes into Braves stadium bonds.

Commissioner Lee’s communication director Kellie Brownlow recently noted the overall property tax rate in Cobb County has been lowered by .5 millage points. (See Ms. Brownlow’s blog comments on the Field of Schemes article “Cobb County spent all its money on Braves stadium, doesn’t have enough left for public parks”.)

It’s unclear why the Board of Commissioners would decrease the property tax millage rate, but then not fund the $40 million Park Bond referendum voters approved 8 years ago. Even a small portion of that tax decrease could easily pay for the entire 2008 Park Bond and solve this funding dilemma.

Two main reasons why Park Bond 2008 funding is so critical now:

• Threat of Development: Many of the 29 properties selected for purchase with the 2008 Park Bond funds have already been developed. Many other listed Park Bond properties are under threat of development, such as the 46-acre Bells Ferry property in North Cobb, the 23-acre Furr property in South Cobb, and the 54-acre Tritt property in East Cobb, among others.

• Greenspace Goals: Cobb’s stated goal in the 2030 Plan is to save at least 10.5 percent of county land as greenspace. Currently Cobb has less than 7 percent saved, so Cobb needs to purchase more than 8,000 acres to achieve their goal. For perspective, Park Bond 2006 saved fewer than 400 acres, and no parkland has been purchased in Cobb for nearly a decade.

To encourage the Board of Commissioners to fully fund Park Bond 2008, park bond supporters have sent Commissioners more than 1,000 emails, spoken eloquently at Board of Commissioners meetings, and written many letters to the editor.

The Board of Commissioners should do the right thing by fully funding the $40 million Park Bond 2008 before moving the property taxes originally intended for park bond repayment into any other project, such as the Braves stadium. If there are plenty of Debt Service funds available for both projects, then it’s really a matter of the Board of Commissioners stepping up to the plate and hitting a home run to honor the vote of the people.

Jennifer Burke of Marietta is a member of the Cobb Parks Coalition.

MDJ Editorial Park Bonds mixed up in Braves deal and why funding is critical now

Here’s a short history on how Park Bond 2008 became mixed up in Braves stadium funding:

• In 2008, 67 percent of Cobb citizens voted for a $40 million Park Bond referendum to save land as parks.

• In 2009, the Board of Commissioners chose not to fund the Park Bond due to the economy, though the County notified 29 landowners their properties were ideal for parkland purchase with the 2008 Park Bond.

• In 2013, Cobb County announced the property tax rate originally intended for Park Bond repayment in the Debt Service Fund would be “shifted” into the $400 million Braves stadium financing. The problem with the transfer is it doesn’t include funding the 2008 Park Bond Referendum voters approved.

• Since 2014, the Cobb Parks Coalition and other like-minded groups have pushed for Park Bond 2008 to be fully funded before the tax shift.

To avoid the controversy of Braves stadium funding superseding Park Bond funding, the Board of Commissioners has a simple solution: Fully fund the $40 million Park Bond approved by referendum before moving the Debt Service Fund taxes into Braves stadium bonds.

Commissioner Lee’s communication director Kellie Brownlow recently noted the overall property tax rate in Cobb County has been lowered by .5 millage points. (See Ms. Brownlow’s blog comments on the Field of Schemes article “Cobb County spent all its money on Braves stadium, doesn’t have enough left for public parks”.)

It’s unclear why the Board of Commissioners would decrease the property tax millage rate, but then not fund the $40 million Park Bond referendum voters approved 8 years ago. Even a small portion of that tax decrease could easily pay for the entire 2008 Park Bond and solve this funding dilemma.

Two main reasons why Park Bond 2008 funding is so critical now:

• Threat of Development: Many of the 29 properties selected for purchase with the 2008 Park Bond funds have already been developed. Many other listed Park Bond properties are under threat of development, such as the 46-acre Bells Ferry property in North Cobb, the 23-acre Furr property in South Cobb, and the 54-acre Tritt property in East Cobb, among others.

• Greenspace Goals: Cobb’s stated goal in the 2030 Plan is to save at least 10.5 percent of county land as greenspace. Currently Cobb has less than 7 percent saved, so Cobb needs to purchase more than 8,000 acres to achieve their goal. For perspective, Park Bond 2006 saved fewer than 400 acres, and no parkland has been purchased in Cobb for nearly a decade.

To encourage the Board of Commissioners to fully fund Park Bond 2008, park bond supporters have sent Commissioners more than 1,000 emails, spoken eloquently at Board of Commissioners meetings, and written many letters to the editor.

The Board of Commissioners should do the right thing by fully funding the $40 million Park Bond 2008 before moving the property taxes originally intended for park bond repayment into any other project, such as the Braves stadium. If there are plenty of Debt Service funds available for both projects, then it’s really a matter of the Board of Commissioners stepping up to the plate and hitting a home run to honor the vote of the people.

Jennifer Burke of Marietta is a member of the Cobb Parks Coalition.

MDJ Editorial Park Bonds mixed up in Braves deal and why funding is critical now

RSS Feed

RSS Feed